This report analyzes Palantir (PLTR), highlighting its government-led revenue, growing consumer segment, and strong financials. Government deals offer stability but carry political risk, while consumer growth aids diversification. Despite solid cash flow, TAM uncertainty clouds long-term projections. A DCF model with mean CAGR yields a $90 price target. The stock is rated “hold” due to balanced strengths and uncertainties.

Company Overview

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

It provides Palantir Gotham, a software platform, which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the hand-off between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform.

The company also offers Palantir Foundry, a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place.

In addition, it provides Palantir Apollo, a software that delivers software and updates across the business, as well as enables customers to deploy their software virtually in any environment; and Palantir Artificial Intelligence Platform that provides unified access to open-source, self-hosted, and commercial large language models (LLMs) that can transform structured and unstructured data into LLM-understandable objects and can turn organizations’ actions and processes into tools for humans and LLM-driven agents.

The company was incorporated in 2003 and is headquartered in Denver, Colorado.

Executive Summary

This research report provides an in-depth analysis of Palantir Technologies Inc. (PLTR), focusing on key aspects such as revenue breakdown, growth trends, and financial performance. Palantir primarily generates revenue from two main segments: government and consumer. The government sector remains the dominant source, with high-value contracts from federal and local government agencies, but its growth is subject to political and policy changes, making it a high-risk area. On the other hand, the consumer sector, while smaller, has been showing strong growth, with increasing demand from private enterprises looking to leverage Palantir’s data analytics solutions. The company’s ability to expand its consumer base is crucial for future diversification and growth.

The report also examines the characteristics of Palantir’s government deals, which often involve long-term contracts with substantial value. These deals provide a stable revenue stream but are heavily influenced by shifting political priorities and government budgets, presenting an element of unpredictability. Meanwhile, the consumer sector faces a more competitive landscape, but Palantir’s proprietary software and unique value proposition allow it to maintain a competitive edge.

In terms of financial performance, Palantir demonstrates a solid financial foundation, with strong cash flow generation and profitability. However, the company’s growth trajectory remains difficult to predict due to the challenges in estimating the Total Addressable Market (TAM), which is integral to long-term revenue projections. A Discounted Cash Flow (DCF) analysis using the mean Compound Annual Growth Rate (CAGR) suggests a price target of $90 for Palantir.

Given the current macroeconomic instability and the inherent risks associated with government contracts, the report recommends a “hold” rating. This reflects the cautious stance toward the stock, factoring in both the company’s solid fundamentals and the unpredictable external factors affecting its future growth.

Revenue Breakdown

Palantir reports its revenue in two segments: Government and Commercial. The table below summarizes each segment’s revenue from 2019 through 2024, along with the segment’s percentage of Palantir’s total revenue and year-over-year (YoY) growth.

| Year | Segment | Revenue (USD millions) | % of Total Revenue | YoY Growth |

|---|---|---|---|---|

| 2024 | Government | $1,570 million | 55% | +28% |

| Commercial | $1,296 million | 45% | +29% | |

| 2023 | Government | $1,222 million | 55% | +14% |

| Commercial | $1,003 million | 45% | +20% | |

| 2022 | Government | $1,072 million | 56% | +20% |

| Commercial | $834 million | 44% | +29% | |

| 2021 | Government | $897 million | 58% | +47% |

| Commercial | $645 million | 42% | +34% | |

| 2020 | Government | $610 million | 56% | +76% |

| Commercial | $482 million | 44% | +21% | |

| 2019 | Government | $346 million | 46.5% | – |

| Commercial | $397 million | 53.5% | – |

As shown above, Palantir’s Government segment contributed 55% of total revenue in 2024, while the Commercial segment contributed 45% . This split has remained near the mid-50s for government vs mid-40s for commercial in recent years. Notably, in 2021 the government business peaked at about 58% of total revenue , reflecting Palantir’s deep roots in government contracts. Earlier years are not officially broken out by segment, but Palantir was historically known for its government work and only began expanding more significantly into commercial markets around 2016–2018.

Product/Service by Segment

Palantir’s platforms are generally applicable across both segments, but certain products have historically been associated with either government or commercial use cases. The table below maps Palantir’s key products to the segment where they are primarily used or marketed, along with a brief description of each product’s function (as described in official disclosures):

| Segment | Product/Service | Description / Function |

|---|---|---|

| Government | Palantir Gotham | An AI-ready operating system for defense and intelligence operations. Enables users (e.g. military, intelligence analysts) to integrate and analyze disparate data to identify hidden patterns and respond to threats. Used broadly across government functions. Gotham was Palantir’s first platform, originally designed for U.S. national security and counterterrorism analytics. |

| Government | Palantir Apollo | A continuous delivery and deployment system that manages and updates Palantir software in any environment (cloud, on-premises, classified networks). Ensures critical systems (like Gotham) receive updates and run reliably even in secure or isolated government IT environments. (Apollo was introduced as a commercial offering in 2021, but it underpins both segments by allowing software to run in virtually any infrastructure.) |

| Government | Palantir AIP | The Artificial Intelligence Platform, introduced in 2023, which integrates advanced AI (including large language models) into Palantir’s software. AIP allows government users to leverage generative AI on sensitive data within Gotham/Foundry while respecting legal, ethical, and security constraints. This is used to help defense and public sector customers operationalize AI for decisions (e.g., military planning, intelligence analysis). |

| Commercial | Palantir Foundry | An enterprise data integration and analytics platform used by commercial industries. Foundry acts as a central operating system for an organization’s data – allowing business users, analysts, and data scientists to clean, integrate, and analyze large volumes of data in one place. It enables faster experimentation and decision-making in sectors like finance, healthcare, energy, and others. (All Palantir’s commercial customers use Foundry, and some government customers use it as well.) |

| Commercial | Palantir Apollo | (Same platform as above.) Apollo supports commercial clients by automating software delivery and maintenance across cloud or on-premises environments. For example, a commercial customer can deploy Foundry in their private cloud or edge devices with Apollo handling updates, ensuring minimal downtime. This is crucial for industries with hybrid IT setups. |

| Commercial | Palantir AIP | (Same platform as above.) AIP allows Palantir’s commercial clients to embed AI and large language models into their operations. It enables enterprises to derive insights from their proprietary data using AI, within Foundry’s ecosystem. For instance, a manufacturing company can leverage AIP to optimize supply chain decisions with AI, using Foundry’s data foundation but without compromising data security or privacy. |

Palantir’s Gotham and Foundry platforms form the core of its government and commercial offerings, respectively. Gotham was originally created for government intelligence and defense use, helping agencies fuse complex datasets and drive mission-critical decisions. Foundry was later developed (launched in 2016) to bring similar data integration capabilities to commercial enterprises, enabling them to operate from a central data platform. Supporting these, Apollo serves as the backbone for software deployment in both segments – it allows Palantir’s applications to run in diverse environments and receive continuous updates, which is particularly important for government clients with air-gapped networks as well as businesses with hybrid cloud setups. The newest addition, AIP (Artificial Intelligence Platform), spans both segments as well, injecting Palantir’s solutions with advanced AI and large-language models. AIP is designed to let users in either segment leverage AI on their secure data – whether it’s a military analyst using AI-assisted decision tools or a company applying AI to business data – all within Palantir’s governed platforms. Each product complements Palantir’s strategy of offering integrated, out-of-the-box software that can be adapted to solve complex data problems in both the public and private sectors.

Government Segment Revenue

The table below details the Government segment’s revenue from 2019 through 2024, along with YoY growth and its share of Palantir’s total revenue each year:

| Year | Gov. Revenue (USD M) | YoY Growth | Share of Total |

|---|---|---|---|

| 2024 | $1,570 | +28% | 55% |

| 2023 | $1,222 | +14% | 55% |

| 2022 | $1,072 | +20% | 56% |

| 2021 | $897 | +47% | 58% |

| 2020 | $610 | +76% | 56% |

| 2019 | $346 | – | 46.5% |

The government segment has grown substantially over the past several years. Revenue from government customers more than quadrupled from around $346 million in 2019 to $1.57 billion in 2024, making it the larger of Palantir’s two segments in every year of public reporting. The most dramatic jump occurred in 2020, where government revenue rose ~76% year-over-year, reflecting major new contracts (for example, expanded U.S. government deals during the COVID-19 response period). Growth remained high at +47% in 2021, with government revenue reaching $897 million. This growth led the government division to comprise 58% of total revenue in 2021, its highest share in the period.

After 2021, growth in government revenue slowed to about +20% in 2022, then only +14% in 2023. Despite this deceleration (likely as large defense and public-sector contracts were fully ramped up or timing of new deals moderated), 2023 government revenue still hit $1.22 billion. Notably, 2024 saw an acceleration back to +28% growth for the government segment, bringing it to $1.57 billion. This resurgence suggests a significant uptick in governmental demand or deployments in 2024, and government clients continued to account for 55% of Palantir’s total sales in 2024. Overall, the data shows the government segment’s revenue trajectory has been upward, with inflection points around 2020–2021 (rapid expansion) and a renewed growth push in 2024. Even in years of slower growth, the government business delivered steady increases and remained a core revenue driver for Palantir.

Major Government Contracts

| Deal Name | Timing | Summary | Revenue Generated | Source Citation | Market Response |

|---|---|---|---|---|---|

| NHS England – COVID-19 Data Store | 2020-Dec | Two-year agreement for Palantir’s Foundry platform to power NHS England’s COVID-19 data store, enabling pandemic data management, resource allocation, and vaccine rollout planning. | £23.5 M (≈$31 M) | Palantir Continues Vital NHS Work With $31.5M Contract | Palantir shares little changed on announcement, but the deal secured a foothold in UK healthcare post-IPO. |

| USSOCOM – Mission Command Platform | 2021-May | Contract to serve as U.S. Special Operations Command’s enterprise data management and AI-enabled mission command platform. Palantir’s tech provides special forces with real-time mission planning, situational awareness, and operational intelligence. | $111 M (2-year) | Palantir Awarded $111m Contract to Provide Mission Command Platform for the United States Special Operations Command | Stock jumped ~14% around announcement (mid-$21 to ~$24) as investors welcomed Palantir’s contract renewal. |

| U.S. Army – DCGS-A Data Fabric (Cap Drop 2) | 2021-Oct | Award to build the Army’s “data fabric” for its Distributed Common Ground System (intelligence platform). Palantir’s Gotham software will integrate global intel data, modernizing battlefield analytics and decision-making for multi-domain operations. | $823 M (multi-year IDIQ) | Army Awards Palantir $823M Contract For Enterprise ‘Data Fabric’ – Breaking Defense | Palantir stock surged 10–15% on the announcement, though it pared gains by next day (Oct 6, 2021). |

| U.S. CDC – Disease Surveillance COP | 2022-Dec | Five-year deal consolidating Palantir’s pandemic-era systems (HHS Protect, Tiberius, etc.) into a unified “Common Operating Picture” for disease surveillance. Supports CDC’s long-term outbreak response beyond COVID-19 (e.g. monkeypox, RSV). | $443 M (5-year) | CDC awards Palantir consolidated disease surveillance contract worth $443M | Shares rose ~5% in the days after announcement, as the contract bolstered Palantir’s government backlog. |

| UK Ministry of Defence – Enterprise Deal | 2022-Dec | Three-year enterprise agreement to deploy Palantir software across UK defense. Expands a prior Royal Navy pilot into ministry-wide adoption for operations and intelligence, leveraging Palantir’s AI to improve decision-making amid heightened focus from the Ukraine conflict. | £75 M (≈$91 M) | Palantir lands 75 million pound deal with British military | Stock ticked up ~3% on Dec 21, 2022, a modest boost as investors saw continued international defense traction. |

| U.S. Air Force – Data Platform Contracts | 2023-Jun | Multiple awards providing Palantir’s data-as-a-service platforms for the U.S. Air and Space Forces. Includes an HQ data integration system and a space situational awareness platform for Space Command centers (NSDC and CSpOC). | ~$110 M (combined) | Palantir racks up more than $100M in new Air Force contract awards to provide data-as-a-service | No significant immediate stock move; news was anticipated as Palantir deepened its Air/Space Force engagement. |

| U.S. Army – AI/ML Research Contract | 2023-Sep | Contract (through 2026) for up to $250M to research and experiment with artificial intelligence and machine learning for the Army. Funds development of AI models for battlefield applications, reflecting DoD’s growing investment in advanced analytics. | $250 M (ceiling) | Palantir wins $250 million US Army AI research contract) | Little immediate boost; shares were flat-to-down amid broader market weakness, despite the strategic AI focus. |

| NHS England – Federated Data Platform | 2023-Nov | Seven-year project to develop the NHS Federated Data Platform, integrating patient data across the UK health system. Aims to tackle care backlogs and improve coordination, with Palantir leading a consortium to deliver this nationwide health data infrastructure. | £330 M (≈$412 M) | UK’s NHS hands U.S.-based Palantir contract for patient data software | Stock fell ~6% on announcement (Nov 21, 2023) as contract value came in at the low end of expectations, though it recovered later. |

| U.S. Army – Vantage Recompete (Data Platform) | 2024-Dec | Follow-on contract to continue Palantir’s Army Vantage analytics platform (now Army’s core data platform). One-year base plus multiple option periods (potential ~$619M total) to provide a SaaS data backbone for Army-wide readiness and operations. | $400.7 M (base award; ~$619 M max) | Palantir Secures $401M Follow-On Army Vantage Support Contract – GovCon Wire | Stock gained ~3% on Dec 18, 2024 and continued upward into year-end, reflecting confidence in Palantir’s renewal. |

Individual Deal Analysis

NHS England (COVID-19 Data Store), Dec 2020

This £23.5 million two-year contract had modest direct financial impact (under 5% of annual revenue) but was strategically significant. It extended Palantir’s role in the NHS beyond an emergency pilot, ensuring continued revenue from the UK public sector. Investor reaction was muted, as the deal’s size was relatively small, but it demonstrated Palantir’s ability to secure renewal business overseas. Strategically, this win cemented Palantir’s credibility in healthcare, laying the groundwork for larger NHS projects to follow.

U.S. Special Operations Command (Mission Command), May 2021

Valued at $111 million over two years, this contract helped sustain Palantir’s government revenue growth (roughly ~7% of 2021 revenues). It was a recompete that Palantir won, underscoring strong customer retention. The stock jumped sharply (~14% gain around announcement) as investors saw affirmation of Palantir’s role in defense programs. Management highlighted on earnings calls that such renewals support margins through recurring software licensing. Strategically, the USSOCOM deal was pivotal – it was one of Palantir’s earliest military clients and its extension signaled trust in Palantir’s platform for mission-critical operations.

U.S. Army – DCGS-A Data Fabric, Oct 2021

This seven-year $823 million award (Palantir’s largest post-IPO contract) materially boosted the company’s backlog and long-term government revenue outlook. Investors reacted very positively – Palantir’s stock spiked in double digits on the news – reflecting the deal’s scale and validation of Palantir’s technology over incumbents. In earnings commentary, executives noted this contract would meaningfully contribute to annual government segment growth once fully ramped. Strategically, winning the Army’s Distributed Common Ground System modernization (beating a defense prime) was a watershed moment, positioning Palantir as a core Army partner and opening the door for follow-on work in battlefield intelligence systems.

U.S. CDC – Disease Surveillance “Common Operating Picture,” Dec 2022

This $443 million five-year deal consolidated several existing public health contracts into one, securing and slightly expanding Palantir’s work with U.S. health agencies. The immediate revenue impact was to stabilize government growth – essentially locking in multi-year software subscription fees that Palantir had been earning through COVID-response contracts. The market viewed it as a positive, though not transformative, development; Palantir’s stock rose modestly (~5% over the week) as it signaled successful transition of pandemic-era programs into long-term business. Strategically, the CDC contract is significant as it entrenches Palantir in federal health infrastructure (beyond the emergency phase) and could yield high-margin recurring revenue while showcasing Palantir’s role in national preparedness.

UK Ministry of Defence – Enterprise Agreement, Dec 2022

Palantir’s £75 million (~$91 M) deal with the UK MoD, spread over three years, contributed to international revenue growth (the UK became ~10% of Palantir’s total sales). The stock had a mild uptick on the announcement, but the broader 2022 market downturn muted any major rally. Financially, this contract adds a steady mid-sized stream of revenue; given Palantir’s high software gross margins, even a ~$30M/year deal supports earnings. More importantly, it signaled strategic expansion: Palantir is now a core platform across the British armed forces, not just a pilot project. This deepens Palantir’s NATO-aligned defense portfolio and could lead to additional modules or renewals. It also highlighted Palantir’s relevance in the context of the Ukraine war, as allied militaries invest in data-driven systems.

U.S. Air Force / Space Force Data Platforms, June 2023

Palantir secured a set of Air Force contracts totaling around $110 million to provide data integration and analytics platforms for Air Force Headquarters, Space Force’s operations centers, and NORAD/NORTHCOM. While individually smaller, collectively they represented a significant expansion in the DoD’s use of Palantir beyond Army and Special Forces. The financial impact was additive but not game-changing – these contracts likely contributed a few percentage points to 2023 government revenue. Investor reaction was neutral; the stock did not move significantly on these specific awards, as they were expected in light of Palantir’s prior work with Space Command. Strategically, however, the deals are meaningful: they established Palantir in the Air Force and Space Force as an enterprise provider, paving the way for potential larger programs.

U.S. Army – AI/ML Research Contract, Sep 2023

This contract, worth up to $250 million through 2026, is structured as an IDIQ for AI R&D services. The revenue contribution will depend on task orders, but it underscored Palantir’s role in cutting-edge defense technology. The stock market response was subdued (Palantir’s share price saw no notable jump on the news, amid a broader late-September tech selloff). However, on the Q3 2023 earnings call, management highlighted it as evidence of Palantir’s leadership in operational AI and potential to drive future growth. Strategically, the Army AI award is significant in that it positions Palantir at the heart of the Pentagon’s AI modernization efforts – a signal that its platforms are trusted not just for data aggregation but also for developing and fielding AI models for warfighting.

NHS England – Federated Data Platform, Nov 2023

This high-profile £330 million (~$412 M) contract (over seven years) is one of Palantir’s largest international wins. Financially, it promises a stable long-term revenue stream (roughly $50–60M annually at full ramp) and significantly boosts the company’s U.K. segment. Interestingly, the stock fell about 6% on the day of announcement – investors had anticipated a potentially larger award (the contract’s maximum value was touted up to £480M), so the confirmed size tempered near-term enthusiasm. Some analysts also noted the long timeline means revenue recognition will be gradual. Strategically, however, this deal is a cornerstone for Palantir: it solidifies their position in global healthcare IT and could lead to expansion into other national health systems if successfully delivered. It also vindicated Palantir’s decision to persist in the NHS despite political scrutiny. In the long run, management sees it as a validation that Foundry can be the backbone of large-scale health data infrastructure.

U.S. Army – Vantage Recompete, Dec 2024

Palantir’s year-end 2024 award for Army Vantage (the Army’s analytics platform) – $400.7 million with options up to $619 million – secured one of its key existing programs for several more years. This had a favorable financial impact: it prevented a potential revenue gap from Vantage’s prior contract expiration and ensured continuity of a high-margin SaaS contract. The stock reacted positively (up a few percent on the day and continuing to trend upward as part of Palantir’s strong 2024 finish) as investors gained confidence that Palantir can not only win new deals but also hold onto major ones in recompetes. Executives likely emphasized on calls that this deal would contribute to stable government revenue growth into 2025–2026 and help maintain Palantir’s adjusted operating margins, given the software reusability. Strategically, retaining Army Vantage was crucial – it affirmed Palantir’s status as an incumbent platform that the Army depends on for readiness and data-driven decision support. It also demonstrated that even in the face of competition or “build vs buy” debates, Palantir’s value proposition for enterprise data platforms in defense remains strong .

Commercial Segment Revenue

The table below shows the Commercial segment’s revenue for 2019–2024, with YoY growth and share of total revenue:

| Year | Comm. Revenue (USD M) | YoY Growth | Share of Total |

|---|---|---|---|

| 2024 | $1,296 ([Palantir Revenue Breakdown: Government Vs Commercial | +29% | 45% |

| 2023 | $1,003 | +20% | 45% |

| 2022 | $834 | +29% | 44% |

| 2021 | $645 | +34% | 42% |

| 2020 | $482 | +21% | 44% |

| 2019 | $397 | – | 53.5% |

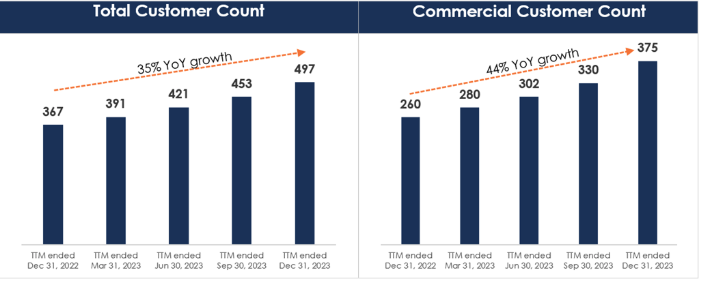

Palantir’s commercial segment has exhibited steady and at times rapid growth, especially as the company broadened its focus beyond government clients. Commercial revenue expanded from roughly $397 million in 2019 to $1.30 billion in 2024, essentially tripling over five years. Year-over-year growth was robust in 2021 at +34%, as commercial sales reached $645 million with wider adoption of Palantir Foundry across industries. Growth then moderated to +29% in 2022 (commercial revenue $834 million) and further to about +20% in 2023, when commercial customers contributed $1.00 billion. Despite the slowdown in 2023, the commercial segment still outpaced the government segment’s growth that year, and its share of total revenue ticked up to 45% from 42% in 2021.

In 2024, commercial revenue re-accelerated to +29% (adding roughly $293 million year-on-year), bringing it to $1.296 billion. This was on par with the government segment’s growth rate in 2024, and kept the commercial share of total revenue at 45%. Over the longer term, the commercial business has grown at a slightly higher compound rate than the government side. For example, from 2021 to 2024, commercial segment revenue doubled (approximately +100%), compared to about +75% growth in government segment revenue over the same period. This reflects Palantir’s strategic push into enterprise and industrial sectors in recent years, leveraging its Foundry platform to penetrate new verticals. It’s also notable that the commercial segment was smaller than government until 2019, but has since remained roughly 40–45% of the company’s sales, indicating that while commercial revenue is growing rapidly, the government segment has also expanded in parallel, maintaining a lead in absolute dollars. In summary, the commercial segment’s data shows strong growth momentum and an increasing contribution to Palantir’s overall revenue mix, even though it currently remains slightly behind government in share of revenue.

Economic Moat

Companies like AWS, Snowflake, and ServiceNow offer data analytics tools, but Palantir distinguishes itself by providing an AI-powered ontology framework that integrates disparate datasets, identifying hidden yet crucial data relationships to facilitate optimized decision-making. Unlike traditional internal IT departments that often rely on fragmented and costly-to-scale patchwork solutions, Palantir builds an intuitive, comprehensive, and continuously improving feedback loop. This structure enables seamless connectivity across organizational functions, significantly enhancing analytical precision and usability.

Palantir collects diverse customer data types, including structured datasets (organized in tables), unstructured information (emails, logs, videos), intelligence records (satellite imagery, threat assessments), operational metrics (supply chains, production data), and analog inputs (physical parameters like temperature or vibration). The platform efficiently cleanses this information, applies advanced machine learning algorithms, and generates actionable, prioritized insights directly applicable to daily operations.

In 2023, Palantir introduced its upsell Artificial Intelligence Platform (AIP), which leverages large language model orchestration, significantly lowering technical barriers for nontechnical users. Palantir’s ontology not only consolidates and visualizes complex data but also prioritizes and ranks it, presenting insights that users can swiftly understand and utilize. This results in tangible efficiency improvements across all operational roles, from healthcare—where patient data optimizes bed turnover—to manufacturing, where analog sensor data informs productivity enhancements.

The cumulative efficiency gains offered by Palantir generate substantial switching costs. Abandoning Palantir’s ontology system would mean reverting to outdated, inefficient frameworks and losing critical productivity improvements. The dynamic, continually updating dashboard provided by Palantir ensures that customers maintain their competitive edge, making renewal virtually indispensable for sustained operational effectiveness.

Let’s dive into a widely accepted metric—Net Revenue Retention (NRR)—to analyze and quantify Palantir’s switching costs and customer retention capabilities. NRR serves as a strong indicator of how well a company retains and grows revenue from its existing customer base. At first glance, Palantir does not top the list in this area; competitors like Snowflake report higher NRR figures, which may suggest stronger customer retention. However, a lower NRR doesn’t necessarily mean Palantir is underperforming. Instead, it reflects the structural differences in its business model. While Snowflake scales revenue rapidly through widespread cloud data services across thousands of smaller clients, Palantir works with fewer but significantly larger and more complex enterprise and government contracts. Digging deeper, key metrics such as average contract value, client expansion cycles, and long-term renewals reveal why Palantir’s NRR may appear lower on paper, even as it maintains strong customer stickiness and high switching costs.

The table below shows the net revenue retention (NRR) for each listed company in fiscal years 2021 though 2024.

| Company | FY2021 | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|

| Palantir | 131% | 115% | 108% | 120% |

| Snowflake | 168% | 178% | 158% | 131% |

| AWS (est.) | ~130% | ~125% | ~110% | ~105% |

| ServiceNow | ~125% | 125% | ~125% | ~125% |

| Databricks (est.) | ~150% | ~150% | ~140% | ~140% |

| Datadog | ~150% | 145% | 115% | ~115% |

| Splunk (Cloud DBNRR) | ~130% | 132% | 123% | ~115% |

Notes: AWS (Amazon Web Services) and Databricks do not publicly disclose NRR, so values are approximate estimates based on industry analysis. Splunk reports NRR for its cloud business only (Cloud DBNRR), reflecting the expansion rate of its cloud customers.

Government-Heavy Revenue Mix Limits Upsell Potential

Over Half of Revenue from Government

Palantir has historically derived 50–55% of its revenue from government clients. This high public-sector mix can inherently constrain NRR. Government agencies tend to have fixed budgets and rigid procurement processes, which limit the scope for rapid upsells or usage expansion mid-contract. Palantir’s large government contracts often come with predetermined scopes or ceilings, meaning revenue can’t easily grow beyond the initial award without new approvals. For example, Palantir’s expanded U.S. Army “Vantage” contract is valued at $400.7M over four years with a $618.9M ceiling – any spend beyond the base value requires additional funding authorizations. Such structures cap organic growth in those accounts.

Steady but Slower Growth in Government Accounts

Government customers are extremely “sticky” (low churn) but typically grow at a modest pace. Palantir’s government deals often deliver lumpy, project-based increments rather than the continuous consumption growth seen in cloud software. As Morningstar notes, large government contracts create lumpiness in Palantir’s revenue. In practice this means a big initial implementation (boosting revenue once) followed by relatively flat recurring spend or incremental add-ons. This dynamic pulls down net retention – once a government deployment reaches full capacity, year-over-year spend might only increase by low single-digit percentages (if at all) absent a new contract or expansion phase. In contrast, commercial SaaS customers typically expand usage more freely year to year, contributing to higher NRR for peers.

It’s worth noting that Palantir’s government segment can produce bursts of expansion – for instance, during 2020–21 Palantir saw surging U.S. government growth (74% YoY at one point) which temporarily drove government NRR above 140%. However, those were exceptional ramp-ups on initial programs. Once those programs matured, growth normalized to a lower rate, leaving Palantir’s overall NRR in the ~110% range. In summary, Palantir’s reliance on federal contracts – while providing revenue stability – tends to constrain upsell velocity, unlike the more flexible spending patterns of enterprise clients.

Contract Structure & Renewal Dynamics vs. Peers

Long-Term, Fixed Commitments

Palantir’s contracts (especially government and large enterprises) are often multi-year agreements with defined scopes or usage commitments. The company typically sells its platform on a subscription basis with a set entitlement, and charges for overages beyond that limit. This model means customers lock in a certain usage level for the contract term. Upselling during the term requires either hitting the usage cap (to trigger overage fees) or renegotiating the contract – a slower process. By contrast, peers like Snowflake and Databricks use pure usage-based billing, where customers’ spend automatically rises with increased consumption of the service. Snowflake’s NRR exemplifies this usage-driven expansion: it peaked around 158% in 2021 and was still 126% as of early 2025. In other words, existing Snowflake customers on average grew their spend ~26% in the past year, purely through greater usage. Palantir’s customers, in aggregate, only expand about 8–15% on average, indicating far less “frictionless” growth within the install base.

“Land-and-Expand” vs. Large Upfront Deals

Palantir’s sales approach has traditionally involved very large initial deal sizes (enterprise-wide deployments). The average Palantir customer historically paid ~$5 million per year, and its top 20 customers contribute outsized revenue (~45% of total). This means Palantir often “lands” at scale, leaving less room for exponential expansion thereafter. By contrast, many high-NRR SaaS peers start with smaller deployments and then expand widely. ServiceNow, for example, lands one of its IT workflows in a division, then upsells multiple other modules and additional users across the enterprise, yielding ~125% net retention on a large base. Snowflake often starts with a limited usage trial that can grow 10x as more data and workloads migrate to the platform. Palantir’s big upfront implementations can saturate an organization’s immediate needs, so follow-on growth is more incremental (e.g. adding a new use case or department) rather than doubling spend each year.

Renewal Timing and Flexibility

The timing of contract renewals also affects NRR. Palantir’s multi-year deals often lock in a fixed annual run-rate until renewal. Upsells may happen at renewal (every 2–3+ years) rather than continuously. Peers with more flexible or modular pricing can upsell mid-term. For instance, ServiceNow’s enterprise customers frequently expand subscriptions before the term ends by adding new ServiceNow product lines. Similarly, Snowflake customers consuming beyond their prepaid credit can simply purchase more within the year. Palantir’s model is improving (the company has introduced usage-based pricing options on platforms like AWS Marketplace, but it still leans toward large, predefined deals – especially in government. This difference in contract flexibility means Palantir’s expansion revenue tends to lag behind those of its cloud-native, usage-based peers.

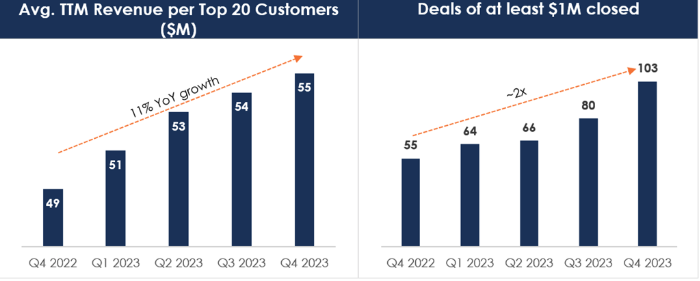

Finally, customer concentration plays a role. With Palantir’s top 20 clients averaging $55M each in annual revenue, any single client’s growth (or stagnation) heavily impacts overall NRR. By having many smaller customers, peers dilute this effect and can rely on a wider base of expansions. In Palantir’s case, if a few large government clients simply renew at flat spending, it weighs down the net retention percentage significantly. Thus, Palantir’s enterprise-heavy portfolio inherently yields a lower blended NRR compared to say, a Snowflake which counts thousands of customers whose usage can independently surge. Few companies can boast NRR above 110% today – Palantir’s ~120% is “slightly below best-in-class peers” like Snowflake (127%) but still healthy for a high-touch enterprise software model. The gap comes down to Palantir’s slower-growing contract base versus the rapid consumption expansion seen in data-cloud peers.

Segment-Level NRR: Government vs. Commercial

Palantir has, on occasion, broken out NRR by segment. In 2021, the company reported exceptionally high retention in both major segments – 146% NRR in its government business and 150% in U.S. commercial – driving a 131% total NRR that year. This indicates that during that period, existing customers (both government and commercial) grew their spend by ~46–50% on average, an unusually strong expansion. However, those figures reflected early ramp-ups on key contracts (for example, expansion of defense programs and initial Foundry rollouts in large companies). Such growth proved unsustainable as the customer base widened.

Government vs. Commercial Behavior

Palantir does not publicly report current NRR separately for government and commercial segments, but we can infer trends. The steep drop in total NRR from ~130% in 2021 to ~110% in 2022 suggests that government upsells tapered off significantly (since government was more than half of revenue). Those early big jumps in government spend (146% NRR) were likely one-time increases as agencies expanded initial deployments. After that, many government customers probably maintained steady spend (near 100% retention) or only modest growth, pulling that segment’s NRR down into the low 100s%. The commercial segment, meanwhile, has been growing faster and contributing more to upsell. In 2023–24 Palantir’s U.S. commercial revenue grew ~50% YoY, outpacing U.S. government’s ~38%. This implies strong expansion in many commercial accounts (along with new customer additions). We can reasonably deduce that commercial clients now have higher net retention than government clients, given their higher growth and Palantir’s focus on expanding usage of new offerings like its AI Platform (AIP) in the private sector. Management commentary has reinforced this: Palantir saw a “diversification away from core government business” with commercial traction, and acknowledges that future growth (and upsell) will be driven more by commercial clients.

Trend Analysis

Segment-level retention has thus converged to a more normalized level. In early years, both segments had outsized NRR due to low customer counts and rapid initial expansions. Now, with a broader base of ~900+ total customers, Palantir’s NRR stabilizing around 110–120% indicates that on average: government accounts are likely near 100–105% NRR (steady renewals with slight increases), while commercial accounts are higher (potentially 120%+ NRR in regions like U.S. commercial). This mix averages out to the reported total. Notably, Palantir’s international government business was once extremely high-retention (even >160% in 2021 on a small base), but international growth slowed in subsequent years, contributing to the overall NRR decline. On the other hand, the expansion of new commercial use-cases (e.g. AIP, Foundry for new industries) in 2023 has begun to lift NRR again. In Q2 2023 Palantir’s net retention was 114%; by Q4 2024 it reached 120%, a 12 percentage point YoY increase as existing customers adopted more of Palantir’s AI capabilities. This uptick supports the view that commercial upsell momentum is returning, while government remains a stable anchor.

Going forward, Palantir’s shift toward a higher mix of commercial revenue should bolster NRR modestly. Commercial clients generally present greater upsell opportunities – they can expand from one department to company-wide, add new product modules, or increase data workloads over time. Palantir’s own strategy reflects this: its U.S. commercial customer count jumped 4.7× from 2019 to 2021 and continues to grow, and the company is actively leveraging its government-honed AI solutions to win more business with enterprises. As more of these commercial customers mature (and if Palantir’s land-and-expand sales execution improves), net retention could trend closer to peers. Management has explicitly pointed to AIP as a catalyst for expansion, expecting existing customers to increase spend as they integrate Palantir’s new AI offerings. In sum, Palantir’s government segment provides high retention but low expansion, while its commercial segment offers higher expansion potential – the balance of these two drives Palantir’s aggregate NRR. The current ~110% figure, while lower than Snowflake/Databricks, is still above the SaaS industry average and reflects Palantir’s unique dual-market strategy.

Switching Cost in terms of deal structure

Palantir addresses high-stakes challenges with software integral to mission-critical healthcare and military operations, creating significant switching costs. For instance, Tampa General Hospital’s collaboration with Palantir cut patient hospital stays by 30%, directly contributing to improved survival rates. Similarly, Palantir played a pivotal role in compiling intelligence that supported the capture of Osama Bin Laden. In situations where human lives depend on data-driven solutions, switching platforms can result in significant financial and intangible human losses.

Customer Growth

The company’s customer growth has rebounded sharply since mid-2023, driven by strong expansion in its U.S. commercial segment. This success is partly due to Palantir’s innovative boot camp strategy, which enhances engagement through numerous interactions with potential clients. Post-contract, a specialized onboarding process enables Palantir’s engineers to deeply understand customer data, customizing optimal solutions for intricate processes. This distinctive acquisition and retention strategy strengthens customer relationships and fosters sustained growth. Furthermore, Palantir has strategically diversified its revenue stream by expanding commercial clients, who typically offer more favorable contractual terms than government clients.

Risk and Uncertainty

I see Palantir having High Uncertainty, primarily due to the unpredictable scope of its total addressable market (TAM) and the unclear extent to which the company can penetrate that market.

In my view, the adaptability of Palantir’s ontology framework makes its software appealing across a wide range of industries, offering meaningful upside potential. However, the difficulty in accurately sizing the TAM—one of the core inputs in valuing the stock—means that any shift in market expectations can lead to sharp and painful corrections in the share price.

I’ve considered several demand scenarios, and the resulting valuation spread is exceptionally broad, underscoring just how much uncertainty investors must contend with. If the TAM ultimately proves smaller than I anticipate, the stock could underperform significantly.

While I see no direct peer matching the strength of Palantir’s ontology framework today, there remains a real risk that a major tech player, such as Google, could introduce a comparable AI platform. Should such competition emerge, it would likely pressure Palantir’s pricing and market share. That said, the firm’s 10–20-year lead in developing machine-learning-based solutions provides a meaningful defensive moat. Replicating or surpassing its offering would require any challenger to make massive, sustained R&D investments.

Data privacy is another key risk, given the sensitive nature of the information Palantir handles. A major cybersecurity incident could pose ESG concerns. Fortunately, the company’s Cipher platform employs advanced encryption protocols, and there have been no significant breaches to date.

Recent Development

2022: Challenging Start Amid Macro Headwinds

Q4 2021 Earnings (Feb 2022)

Palantir began 2022 on a shaky note. Its fourth-quarter 2021 results showed strong revenue growth but a larger net loss than expected, due in part to hefty stock-based compensation. Management’s lukewarm 2022 revenue guidance also underwhelmed investors. The stock fell about 15% after earnings, as markets grew wary of Palantir’s slowing government business and continued losses. Long-Term Implication: This early stumble set a cautious tone for the year, pressuring Palantir to improve profitability and execution in the face of tightening financial conditions.

Q1 2022 Earnings & War Outlook (May 2022)

Palantir’s first-quarter 2022 results confirmed decelerating growth. Revenue rose ~31% year-over-year, but earnings missed estimates (adjusted EPS of $0.02 vs. $0.05 expected) largely due to losses on Palantir’s SPAC investments. The company also issued a weaker Q2 revenue forecast (~25% YoY growth), citing uncertain timing of big government contracts. Shares plunged over 20% after the announcement. Management noted the war in Ukraine had not yet boosted results, though they anticipated future defense opportunities. Long-Term Implication: The disappointing quarter underscored Palantir’s reliance on governmental deal timing. It prompted Palantir to ramp up its salesforce (sacrificing margins near-term) in hopes of converting geopolitical developments (like increased defense spending amid the Ukraine war) into revenue later on.

Surging Inflation & Rate Hikes (Mid-2022 Macro)

Through 2022, macroeconomic forces weighed heavily on Palantir and other growth stocks. Inflation spiked to 40-year highs (~9% in the US), and the Federal Reserve embarked on aggressive interest rate increases (from near 0% to ~4% by year-end). This environment drove a broad tech sell-off, with unprofitable companies like Palantir seeing outsized declines. By late 2022, Palantir’s share price had sunk about 65% from its January levels, reflecting higher discount rates on future earnings. Long-Term Implication: The macro headwinds forced Palantir to emphasize efficiency and path-to-profitability. Investor sentiment shifted to favor companies with sustainable margins, pressuring Palantir’s management to aim for breakeven sooner than planned.

Q2 2022 Earnings & Guidance Cut (Aug 2022)

Palantir’s second quarter brought more turbulence. Revenue growth slowed to +26% YoY ($473 million), and the company unexpectedly posted a small adjusted loss as lingering SPAC investment losses hit the bottom line. In a key setback, Palantir cut its full-year 2022 revenue outlook to ~$1.90 billion (≈23% growth, down from 30%+ previously). Management blamed “frustrating” delays in government contract awards and foreign currency headwinds weighing on European sales. The stock tumbled about 14–15% on the news. Long-Term Implication: This was a pivotal moment – it became clear Palantir’s once-blistering growth was cooling. The company’s reliance on large, lumpy government deals introduced volatility, and management’s credibility took a hit with the lowered guidance. Palantir responded by doubling down on diversifying its client base (expanding commercial deals) and re-aligning expectations toward more modest, sustainable growth rates.

Strategic Partnerships and Contracts (Late 2022)

Despite a tough year, Palantir secured notable deals that laid groundwork for recovery. In September 2022, Palantir expanded its partnership with South Korea’s Hyundai Heavy Industries, including a $20 million, five-year contract to deploy Palantir’s Foundry platform across shipbuilding and industrial operations. And in the public sector, Palantir won a 5-year, $443 million contract with the U.S. Centers for Disease Control (CDC) to power a disease surveillance data platform. These wins did not immediately move the stock amid bearish market sentiment, but they reinforced Palantir’s long-term opportunities. Long-Term Implication: The Hyundai deal demonstrated Palantir’s push into international and commercial markets, reducing dependence on U.S. government spending alone. The CDC contract highlighted Palantir’s role in critical infrastructure (public health analytics), suggesting a widening moat in government work. Together, these “minor” victories in 2022 provided future revenue streams and reference cases that could spur additional clients.

Q3 2022 Earnings (Nov 2022)

Third-quarter results mirrored prior trends. Revenue growth was +22% (slipping further), and adjusted earnings were just $0.01 per share (a penny shy of forecasts). Notably, Palantir’s U.S. government revenue rose solidly (+26%), but its commercial revenue growth decelerated to 17%, hurt by soft European demand and a strong dollar. The company did reaffirm its lowered full-year guidance (~$1.9 billion revenue), suggesting no further deterioration. The stock fell about 11% on these mixed results. Long-Term Implication: Q3 likely marked the bottoming-out of Palantir’s slump. Investors had largely priced in the bad news by this point – the consistent (if slower) growth and stabilization of guidance helped set the stage for a potential turnaround. Palantir’s focus on controlling costs and weathering the macro storm hinted that better profitability could be within reach once revenue re-accelerated.

2023: Pivot to Profitability and AI-Fueled Rebound

Q4 2022 Earnings – First GAAP Profit (Feb 2023)

Palantir kicked off 2023 with a breakthrough. In its fourth-quarter 2022 report, Palantir announced its first-ever quarter of positive GAAP net income (about $0.01 GAAP EPS, or $0.04 on an adjusted basis). Revenues grew 18% YoY to $509 million, slightly beating expectations. More importantly, management forecasted 2023 would be Palantir’s first profitable year on a GAAP basis and highlighted newfound expense discipline (slower hiring, cutting cloud costs). The company also touted rising interest in artificial intelligence solutions, noting the buzz from OpenAI’s ChatGPT as a tailwind for Palantir’s own AI capabilities. The stock surged 15–20% in after-hours trading on the upbeat news. Long-Term Implication: This quarter was a turning point. Achieving profitability addressed a major investor concern and validated Palantir’s efforts to rein in costs. It gave the company financial flexibility and credibility to pursue growth initiatives. Additionally, management’s focus on AI positioned Palantir to ride a coming wave of demand for enterprise AI integration – hinting that 2023 could couple improving finances with innovation.

Macro Trend – AI Boom and Tech Rally (Early/Mid-2023)

As 2023 progressed, a broader boom in generative AI dramatically shifted market sentiment in Palantir’s favor. Interest rate hikes began to slow and inflation eased, but the standout factor was investor enthusiasm for any company tied to AI. By spring 2023, major advancements like GPT-4 had companies scrambling for AI solutions. Palantir, with its long-standing AI and data analytics pedigree, was seen as a key beneficiary of increased government and corporate AI spending. This macro narrative, combined with Palantir’s newly established profitability, led to a sharp recovery in the stock. From January through July 2023, Palantir’s shares roughly doubled, as investors anticipated that Palantir’s platforms (Foundry, Gotham) and new AI offerings would see surging demand. Long-Term Implication: The AI frenzy provided Palantir an opportunity to redefine its value proposition. No longer viewed solely as a slow-growth defense contractor, Palantir began to be seen as an AI powerhouse. This broadened investor base and set the stage for accelerating sales, especially in the commercial segment, as clients looked to Palantir for cutting-edge AI-driven data analysis.

Q1 2023 Earnings & AIP Launch (May 2023)

Palantir’s first quarter 2023 results reinforced the positive momentum. Revenue grew 18% YoY to $525 million (beating estimates), and adjusted EPS of $0.05 topped forecasts, marking a second consecutive GAAP-profitable quarter. On the earnings call, Palantir stunned observers by announcing it expects to remain profitable every quarter of 2023. The company also unveiled its new Artificial Intelligence Platform (AIP) – a suite allowing customers to harness large language models (the same type of AI behind ChatGPT) on their private data. Early AIP pilots were underway with major clients in insurance, supply chain, and defense. Investors cheered these developments, and the stock jumped about 20% in post-market trading. Long-Term Implication: This quarter signaled that Palantir’s turnaround was in full swing. Consistent profitability allayed financial concerns, while the AIP launch proved Palantir could innovate rapidly in the hottest area of tech. The immediate stock surge reflected optimism that AIP could unlock new commercial use cases (e.g. helping militaries with AI targeting or enterprises with AI-powered decision-making). In the long run, AIP opened a potentially vast new growth avenue and helped Palantir attract strategic partnerships in the AI space.

Steady Growth and New Deals (Mid/Late 2023)

Through mid-2023, Palantir capitalized on its momentum with steady growth and significant contract wins. In the second quarter (Q2 2023), revenue rose a slower 13% (to $533 million), but Palantir beat earnings expectations and raised its full-year outlook slightly. Government revenue re-accelerated over 20% thanks to larger Pentagon projects, and U.S. commercial sales continued to expand double-digits. The stock remained buoyant. Over the summer, Palantir won a prototype contract from the U.S. Army’s TITAN program (~$180 million) to develop an AI-driven battlefield intelligence system, and secured other defense deals as the Pentagon invested more in AI. These deals, while not headline-grabbing to the public, expanded Palantir’s backlog. By the third quarter (Q3 2023), Palantir posted ~17% revenue growth and its third straight quarter of profitability, in line with expectations. Long-Term Implication: The mid-2023 period showed Palantir turning its hype into tangible business. The company was no longer just promising future potential – it was delivering consistent earnings and booking sizeable contracts in both defense and commercial sectors. This execution created a foundation for accelerating growth if macro conditions or big projects (like global defense initiatives) broke in Palantir’s favor.

Major NHS Contract in UK (Nov 2023)

A significant milestone came in late 2023 when Palantir was awarded the contract for Britain’s National Health Service Federated Data Platform. This deal, valued up to £330 million (~$412 million) over seven years, named Palantir as the lead provider of the NHS’s new patient-data management system. The contract had been controversial due to privacy concerns, but Palantir’s win cemented its role in Europe’s healthcare analytics. The immediate stock reaction was muted (the news came amid general market volatility), but analysts viewed it positively as it expands Palantir’s footprint in a huge sector. Long-Term Implication: Winning the NHS platform is strategically important. It showcases Palantir’s ability to handle sensitive, large-scale civil data projects, not just military intel. This could lead to more healthcare (or other civilian agency) opportunities globally. Financially, the contract provides a stable long-term revenue stream. It also demonstrates Palantir’s resilience in highly competitive bids, enhancing its reputation outside the U.S. market.

2024: Acceleration, AI Dominance, and New Highs

Full-Year Profit & Cautious Outlook (Feb 2024)

Palantir reported its 2023 full-year results in early 2024, confirming that it achieved GAAP profitability for the year. This capped off a remarkable turnaround from the losses of 2022. However, the initial 2024 revenue guidance offered by management was somewhat conservative (high-teens percentage growth forecast, roughly in line with 2023’s pace). Investors, who had bid the stock up on AI excitement, were looking for an even more aggressive outlook. As a result, after the fourth-quarter 2023 earnings release, Palantir’s stock saw only a modest uptick – enthusiasm was tempered by the prudent guidance. Long-Term Implication: By now, profitability was expected, so the focus shifted to growth re-acceleration. Palantir’s careful guidance suggested it didn’t want to over-promise, perhaps due to uncertainties in Europe and timing of big contracts. This set up 2024 as a “show me” year: the company needed to prove that the AI-related demand would translate into substantially higher revenue growth.

Q1 2024 Earnings & Stock Pullback (May 2024)

In the first quarter of 2024, Palantir delivered solid results – continuing GAAP profits and ~18% revenue growth – but the market’s attention was on future guidance. The company did raise its full-year 2024 revenue forecast slightly (citing strong AI services demand), yet this upgrade still fell short of the market’s lofty expectations after a massive run-up in the share price. Palantir also noted some unavoidable headwinds in Europe and a longer sales cycle for certain deals. This conservative outlook triggered a sharp selloff; shares dropped over 15% in their worst single-day decline since 2022. Despite the knee-jerk reaction, many analysts remained positive, calling the underlying results “solid” with healthy U.S. commercial growth and widening margins. Long-Term Implication: The May 2024 pullback was a reality check on valuation. It reminded investors that, even in an AI boom, Palantir’s growth would not be limitless quarter to quarter. Importantly, the company still raised guidance – signaling confidence in strong demand – just not as dramatically as some hoped. The stock drop also reset expectations to more reasonable levels, arguably paving the way for further gains as the year progressed and Palantir’s momentum became undeniable.

Defense Contracts Surge – Project Maven (Mid-2024)

Around mid-2024, Palantir’s position in the defense AI arena was emphatically reinforced. In May 2024, the U.S. Army awarded Palantir a $480 million contract to lead Project Maven’s next phase – an artificial intelligence program to analyze military drone and surveillance footage. This was one of Palantir’s largest contracts to date, extending through 2029. It signaled that the Pentagon was deeply committed to Palantir’s technology for mission-critical AI applications. The immediate market reaction to the contract win was positive but measured (large government deals are often long-term in revenue realization). However, it boosted investor confidence that Palantir’s pipeline was blossoming. Coupled with other wins – like an extension of its Army Vantage program worth up to ~$600 million (announced in late 2024) – Palantir’s backlog of government business swelled. Long-Term Implication: These defense mega-deals have profound implications. They lock in multi-year revenue streams and validate Palantir’s status as a go-to provider of AI solutions to the military. The scale of the contracts also suggests Palantir’s technology (including its new AI Platform) is viewed as indispensable for next-generation defense systems. Over time, such deals can drive accelerated growth and high-margin revenue, given Palantir’s software economics.

Q2 2024 – Growth Reignites (Aug 2024)

Palantir’s second-quarter 2024 earnings marked a turning point to outright re-acceleration. The company surprised investors with 36% YoY revenue growth for the quarter – a big jump from the ~18% rates earlier – driven by booming demand in the United States. U.S. revenue was up over 50% as commercial customers scaled AI deployments and government agencies ramped projects like Project Maven. Palantir also recorded its largest-ever quarterly profit and substantially raised its full-year outlook for both revenue and operating income. Notably, management projected ~31% revenue growth for 2025, well above prior consensus. These results crushed expectations and the stock soared roughly 12%–15% in after-hours trading, continuing a strong uptrend. Long-Term Implication: Q2 2024 demonstrated that Palantir could convert the hype around AI into actual top-line acceleration. The inflection in growth suggested that years of pilot programs and smaller deals were now translating into wide-scale adoption of Palantir’s platforms. The raised guidance for 2025 indicated management’s confidence that this was not a one-quarter blip but the start of a sustained high-growth era fueled by AI. For the business, this meant improved economies of scale and the potential to significantly expand margins and cash flow in coming years.

Partnerships and Politics (Late 2024)

By late 2024, Palantir not only enjoyed strong earnings but also favorable external tailwinds. In December 2024, Palantir formed a strategic alliance with Anduril Industries (a fast-growing defense tech firm) to jointly develop AI-driven military technology. This partnership between two leading defense innovators aimed to tackle challenges in integrating and scaling AI for the U.S. military, potentially unlocking new contract opportunities. Meanwhile, the U.S. political climate shifted with the late-2024 elections. Anticipation of a more defense-friendly administration and increased government spending on military and security projects contributed to bullish sentiment on Palantir. Investors bet that a higher defense budget and pro-tech policies would benefit Palantir’s government segment. By the end of 2024, Palantir’s stock had skyrocketed – rising approximately 340% over the year – and reached all-time highs. Long-Term Implication: These developments fortified Palantir’s long-term outlook. The Anduril partnership signaled that Palantir is intent on maintaining a leading edge in defense AI by teaming up with complementary innovators, which could accelerate product development and contract wins. Politically, a climate favoring big defense and infrastructure investments bodes well for Palantir’s pipeline (both defense and even areas like healthcare or energy where government plays a role). However, the soaring stock price also set the stage for greater volatility ahead, as expectations would need to be met or exceeded to sustain such valuations.

Early 2025: Peaks and Volatility

Q4 2024 Earnings – Record Results (Feb 2025)

Palantir’s fourth-quarter 2024 earnings release was nothing short of a blowout. The company reported record revenue and profit, capping off a year of accelerating growth. Revenue for Q4 jumped about 36% year-on-year (reaching the $700+ million range for the quarter), propelled by surging U.S. commercial sales and ramp-ups of major government programs. Profitability also expanded significantly – adjusted operating margins improved as the influx of revenue outpaced costs. Perhaps most striking was Palantir’s forward guidance: management forecasted 31% revenue growth for full-year 2025, well above analyst expectations. This strong outlook “eviscerated” consensus estimates and signaled confidence that the AI-driven growth spurt would continue. The market reaction was exuberant: Palantir’s stock spiked over 20% in one day, hitting new highs (shares traded into the low $100s, giving the company a market capitalization north of $200 billion). Long-Term Implication: This moment represented the pinnacle of investor optimism. Palantir had proven its ability to scale revenue rapidly while maintaining profitability – a combination that could yield tremendous cash generation if sustained. The company’s ambitious 2025 guidance implied that the previous year’s contract wins and product innovations (like AIP) would keep bearing fruit. For Palantir’s strategy, it indicated a successful transition from a niche software provider into a mainstream enterprise and government AI platform. The company’s challenge moving forward would be managing this growth responsibly and continuing to deliver breakthroughs to justify its premium valuation.

Market Jitters – Profit Taking and Budget Concerns (Mar 2025)

Shortly after reaching its peak, Palantir’s stock saw a bout of significant volatility. In late February 2025, news emerged that CEO Alex Karp planned to sell roughly $1 billion of his Palantir shares over time. While insiders often liquidate some holdings, the size of the planned sale surprised the market and prompted worries about valuation. Around the same time, commentary surfaced about potential cutbacks in government spending – with officials in Washington discussing tighter budgets and deficit reduction after years of heavy outlays. Given Palantir’s reliance on government contracts, this sparked concern that its jaw-dropping growth might moderate in the future. These factors combined to trigger a rapid pullback: within a couple of weeks, Palantir’s stock fell about 30% from its highs, erasing some of its early-2025 gains. Long-Term Implication: This volatility was a reminder that Palantir’s stock, after such a huge rally, was priced for perfection. Any hint of insider selling or macro constraints could instigate sharp corrections. From a business perspective, the talk of budget tightening suggested Palantir may face a more measured flow of government deals looking ahead, especially if political priorities shift. However, it’s worth noting that even after the pullback, Palantir’s shares remained dramatically higher than a year prior, reflecting underlying confidence in its business. The company’s task will be to navigate these fluctuations by continuing to diversify its customer base (more commercial clients can balance government cyclicality) and by excelling in execution to retain investor trust.

Looking Ahead (as of April 2, 2025)

Entering the second quarter of 2025, Palantir stands in a fundamentally stronger position than it was a few years prior. The period from 2022 through early 2025 has seen the company transform from an unprofitable, uncertainty-shadowed venture into a profitable, high-growth leader in AI and data analytics. Its stock price, though volatile, reflects a substantial market recognition of that progress. Macroeconomic conditions are a mixed bag: interest rates remain elevated compared to the early 2020s (keeping financing costs higher and growth stock valuations sensitive), but easing inflation and a resilient economy provide a stable backdrop for enterprise spending. Government policy is another evolving factor – while there is pressure to trim budgets, defense and AI remain priority areas in many countries, likely insulating Palantir’s core business to some degree. Long-Term Implication: Palantir’s strategic focus on artificial intelligence, coupled with disciplined financial management, has positioned it to capitalize on the biggest technology and security trends of the mid-2020s. The company’s challenge going forward will be to sustain innovation and top-line momentum (to meet high expectations) while adapting to any macro or policy changes. If it succeeds, Palantir could further entrench itself as a critical software contractor for governments and a go-to AI platform for corporations – reinforcing its competitive moat and supporting continued growth in revenue and shareholder value.

Financial Statement Analysis

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Operating Income ($M) | –161 | 120 | 310 |

| Net Income ($M) | –374 | 210 | 462 |

| EBITDA ($M) | –139 | 153 | 342 |

| Free Cash Flow to Firm ($M) | –267 | 200 | 321 |

| Wtd. Avg. Diluted Shares (B) | 2.064 | 2.298 | 2.451 |

| EPS (GAAP) | –0.18 | 0.09 | 0.19 |

| Net Income Margin | –19.6% | 9.4% | 16.1% |

| P/E Ratio | N/A | N/A | 184.5 |

| ROA | Negative | ~3–5% | ~7–8% |

| ROE | Negative | ~6% | ~10% |

| ROIC | Negative | ~3% | ~6% |

Notes: “N/A” indicates not applicable (e.g. P/E in 2022–23 was not meaningful due to negative or minimal earnings).

Operating Income, Net Income, and EBITDA Analysis

Turnaround from Losses to Profits

Palantir’s operating and net profits swung from negative in 2022 to positive by 2024. In 2022, the company incurred a GAAP operating loss of $161 million (–8% operating margin) and a net loss of roughly $374 million (–19.6% net margin). By 2024, Palantir achieved GAAP operating income of $310 million (11% margin) and net income of $462 million (16% margin). This represents a dramatic improvement, with net income rising by over $800 million from 2022 to 2024. EBITDA followed a similar trajectory – improving from a negative $139 million in 2022 to a positive $342 million in 2024 (an increase driven by higher operating profit and only modest depreciation/amortization).

Drivers of Margin Expansion

The transition to profitability was driven by both revenue growth and cost optimization. Revenue grew about 50% from 2022 to 2024 (from ~$1.91 billion to $2.87 billion), providing scale. Meanwhile, operating expenses grew much more slowly, enabling margin expansion. For example, operating costs in 2024 were up only 19% year-over-year despite 29% higher revenue. This indicates improved operational efficiency and discipline in spending. Notably, Palantir’s stock-based compensation – while still high – was better absorbed by a larger revenue base. Stock-based comp expense did increase to $691.6 million in 2024 (up 45% YoY due to new equity grants and a one-time stock appreciation rights (SARs) vesting) but as a percentage of revenue it held roughly steady. In effect, the company managed to grow its top line faster than its core operating costs, yielding higher operating margins.

Cost Optimization and One-Time Items: Palantir made a strategic shift toward cost control and profitability in this period. Management curtailed the pace of hiring and became more selective in spending, as evidenced by SG&A and R&D growing slower than revenue. Additionally, certain extraordinary expenses that weighed on 2021–2022 results were reduced or eliminated. For instance, Palantir had made a series of speculative investments in SPACs (startups via special-purpose acquisition companies) that backfired – by 2022 it wound down this program, having lost over $300 million on these investments. Those losses (recorded in other expenses) contributed to the 2022 net loss. By discontinuing such non-core activities, Palantir avoided further write-downs in 2023–2024. The company’s first full year of GAAP profitability came in 2023, with net income of $210 million (9% net margin), and improved dramatically in 2024 as operational efficiencies took hold. Palantir’s CEO noted that 2024’s results “astound” and reflect the company’s central role in the emerging AI market – hinting that management’s focus shifted to delivering profitable growth from its AI platform. Overall, margin expansion was achieved through a combination of revenue scale, controlled expense growth, and elimination of prior one-time losses.

Free Cash Flow to the Firm (FCFF) Analysis

FCFF Improvement: Palantir’s free cash flow to the firm (FCFF) improved from –$267 million in 2022 to $321 million in 2024, a swing of nearly $600 million. In 2022, Palantir’s operating cash flow was weighed down by low operating earnings and working capital uses, resulting in negative free cash outflow. By 2024, the company generated substantial cash. Operating cash flow reached $1.15 billion in 2024 (40% of revenue), far exceeding the modest capital expenditures (Palantir’s business is software-focused, requiring relatively low CapEx). Even after any investments and lease payments, FCFF turned solidly positive.

Key Factors: Several factors drove this FCFF improvement:

- Rising Operating Income: The most fundamental driver was the jump in operating profit. Net income of $462 million in 2024, adjusted for non-cash expenses, translated to strong cash generation. Notably, Palantir’s heavy stock-based compensation, while an expense in GAAP net income, is added back in cash flow – for example, the $691.6 million of stock comp in 2024 was a non-cash cost that boosted operating cash flow when excluded. As Palantir became profitable, this stock comp (and other non-cash items like depreciation) made operating cash flow far higher than net income, aiding FCFF.

- Working Capital and Efficiency: Palantir saw favorable working capital dynamics in this period. The company’s customer base and deal sizes grew, often with upfront payments for multi-year contracts. In 2024, cash from operations was 2.5x net income, partly due to collections from customers (increasing deferred revenue and reducing DSO). Improved collections and relatively stable payables/expenses meant less cash tied up in working capital. By contrast, in 2022 Palantir had used cash for things like funding pilot projects and absorbing slower collections, which hurt free cash flow. The shift to more efficient working capital management by 2024 freed up cash.

- CapEx and Investments: Palantir’s capital expenditures remained low (the company primarily uses cloud infrastructure rather than owning data centers). With CapEx minor, operating cash flow improvements flowed directly into FCFF. Additionally, Palantir drastically cut back on its equity investments in other companies. In 2021–22, it spent hundreds of millions investing in client startups (the SPAC program), which was recorded as investing cash outflow. By ceasing this program in 2022, those cash outflows disappeared going forward. In sum, less cash was diverted to risky investments, boosting free cash available to the firm.

- No Debt Burden: Palantir carries no debt on its balance sheet, so its FCFF wasn’t reduced by interest payments. In fact, rising interest rates meant Palantir earned interest income on its large cash reserves, supplementing cash flow. The absence of debt also meant no principal repayments draining cash.

By 2024, Palantir’s FCFF of $321 million reflects a healthy cash-generating business, versus the cash burn in 2022. This improvement underscores the company’s better operating efficiency and more disciplined capital allocation. Management’s focus on profitable growth and winding down non-core uses of cash positioned Palantir to fund its own expansion and even return cash to shareholders (via buybacks) by 2024.

Weighted Average Diluted Shares Outstanding Analysis

Palantir’s diluted share count increased significantly from 2.064 billion in 2022 to 2.451 billion in 2024 (Document). This ~19% rise (about 387 million additional shares) was primarily due to stock-based compensation (SBC) awards to employees and, to a lesser extent, small strategic equity issuances – partially offset by the initiation of share buybacks in late 2023–2024.

To illustrate the key events affecting share count, the table below summarizes major share issuance or repurchase events in this period:

| Date (Year/Qtr) | Event (10-word summary) | Shares Changed | Share Price ($) |

|---|---|---|---|

| FY 2022 | Employee RSU vesting & option exercises (SBC dilution) | +~140 million | ~$10 (avg) |

| FY 2023 | Continued stock-based comp issuance; no buybacks yet | +~230 million | ~$15 (avg) |

| Aug 2023 | Board authorizes $1B share buyback program (no immediate effect) | 0 | ~$16 (annc.) |

| FY 2024 | First share repurchases: ~2.1M shares (~0.1% of float) bought back | –2.1 million | ~$30 (avg) |

Stock-Based Compensation Issuance: The dominant source of dilution was Palantir’s generous equity compensation. The company has historically granted large RSUs and stock options to attract and retain talent. In 2022, as early post-IPO grants vested, roughly 140 million new shares were issued to employees (either through RSU releases or option exercises). This trend continued in 2023 with an estimated ~230 million shares issued as SBC. Crucially, these shares were issued when Palantir’s stock price was relatively low (often in the high-single-digit to low-teens dollars), magnifying the dilution. For example, in 2022 Palantir traded between ~$6 and $18; issuing shares at those prices meant a higher share count impact per dollar of compensation. The cumulative effect is clear: stock-based comp pushed the diluted share count from about 2.06B to 2.30B by 2023. Palantir’s SBC expense was $692 million in 2024 alone, so dilution remained a concern (though management argues this aligns employee incentives with shareholders).

Equity Issuance/Other: Apart from employee compensation, Palantir did not undertake significant equity financings in 2022–2024 – it did not need to, given its ample cash. However, Palantir occasionally issued small amounts of stock in strategic deals. For instance, it sometimes paid vendors or partners in stock or invested in client companies in exchange for equity. These instances were minor (e.g. on the order of a few hundred thousand shares) and did not materially impact the overall share count. Essentially, there were no public secondary offerings or major acquisitions paid in stock during this period. The share count increase is almost entirely attributable to internal factors (SBC), not external fundraises.