Commercial Acceleration Continues: PLTR Delivers Blowout Q1 and Raises FY25 Guidance

Rating: Sell

Target Price: $90

Summary:

Given Palantir’s recent release of updated financial data and the fact that its stock price has significantly exceeded our previous valuation estimates, we deem it necessary to conduct follow-up research on the company. Palantir delivered another strong quarter operationally, with Q1 revenue of $884M (+39% YoY) and significant margin expansion. U.S. commercial performance was particularly strong, with revenue up 71% YoY and record total contract value (TCV) growth. The company also raised full-year guidance across revenue, operating income, and free cash flow. However, while near-term performance continues to exceed expectations, we remain cautious in extrapolating this trend into long-term value due to fundamental uncertainties regarding the Total Addressable Market (TAM)—particularly in the public sector, where demand is deeply sensitive to political, regulatory, and macroeconomic shifts.

Our DCF-based valuation remains unchanged at $90, reflecting the company’s significant long-term potential but limited visibility into the durability of its cash flows. We reiterate a “Sell” rating.

1. Q1 FY2025 Performance Highlights

| Metric | Result | YoY Change | QoQ Change |

| Total Revenue | $884M | +39% | +7% |

| U.S. Revenue | $628M | +55% | +13% |

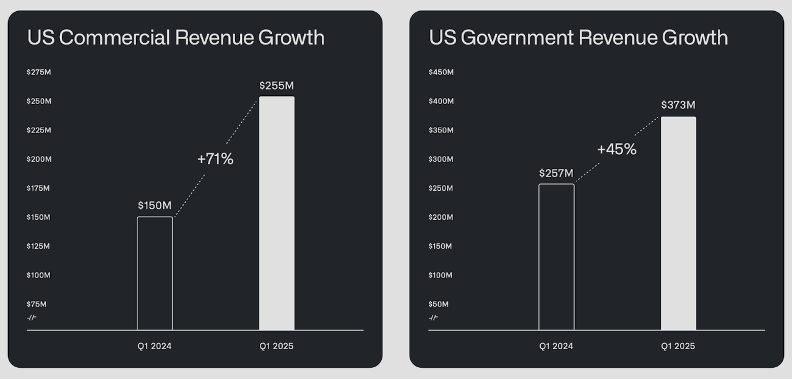

| U.S. Commercial | $255M | +71% | +19% |

| U.S. Government | $373M | +45% | +9% |

| Deals ≥ $10M | 31 | — | — |

| GAAP Net Income | $214M | — | 24% margin |

| Adjusted Op. Income | $391M | — | 44% margin |

| Adjusted Free Cash Flow | $370M | — | 42% margin |

| Cash & Equivalents | $5.4B | — | — |

Notably, Palantir closed its largest-ever quarter of U.S. commercial TCV at $810M (+183% YoY) and saw RDV rise 127% YoY to $2.32B. The Rule of 40 score reached 83%, signaling efficient growth.

2. Revised FY2025 Guidance (Raised)

Q2 Revenue: $934M–$938M

FY Revenue: $3.890B–$3.902B (vs. prior midpoint ~$3.8B)

U.S. Commercial Revenue: ≥$1.178B (+68% YoY)

Adj. Operating Income: $1.711B–$1.723B

Adj. Free Cash Flow: $1.6B–$1.8B

While this outlook is robust, we caution that the lumpiness of contract flow may create disconnects between bookings momentum and long-term financial stability.

3. Investment Thesis Update

What Works Great?

Strong government segment continues to anchor near-term momentum: Government revenue grew 45% YoY to $487M, supported by consistent execution on legacy programs and growing demand for AI-enabled government solutions. In particular, U.S. government revenue reached $373M (up 9% QoQ), while international government revenue also grew 45% YoY, supported by key engagements in the U.K. and new initiatives such as NATO collaboration. TCV bookings from the government side totaled $1.5B, up 66% YoY, reinforcing the segment’s foundational contribution to topline and investor confidence. Looking ahead, industrial reshoring and increased automation efforts may further expand the scope of Palantir’s government and manufacturing platforms—particularly as its Warp Speed solution gains relevance.

Commercial business scaling rapidly, particularly in the U.S.: Palantir surpassed the $1 billion annual run rate milestone in its U.S. commercial business for the first time in Q1, growing 71% YoY and 19% sequentially. Excluding revenue from strategic commercial contracts, growth was even stronger—75% YoY and 22% QoQ. Total U.S. commercial customer count reached 432 (up 65% YoY), and TCV bookings soared to a record $810M (+183% YoY). This reflects the tangible traction of AIP as a key driver of AI production use cases, fueling both new customer wins and deeper penetration in existing accounts. Management is also expanding industry-specific capabilities through strategic partnerships in healthcare and financial services, aiming to tap into multi-billion-dollar opportunities like revenue cycle optimization and AI-enabled productivity tools. These collaborations reinforce Palantir’s push toward broader enterprise adoption.

A series of positive catalysts in April–May 2025 then propelled PLTR up to the $120 mark:

- March 25 – Apr 2025 (NATO AI contract): Palantir won a landmark AI battlefield software deal with NATO for the “Maven Smart System,” one of the fastest contract awards in NATO’s history. Disclosed in mid-April, neither party commented on the terms of the deal, but it was enough to drum up market confidence in Palantir, whose stock rose ~8% in a morning. The NATO deal underscored Palantir’s growing role in defense AI and boosted confidence that similar high-value contracts could follow.

- Mid-May 2025 (Major U.S. Defense Contract): The stock regained strength by mid-May thanks to further positive news. On May 19, Palantir was awarded an indefinite-delivery/indefinite-quantity $217.8 million Space Force contract for a Space Command and Control (C2) platform. This sizable order (via an Air Force/Space Force IDIQ framework) reinforced Palantir’s dominance in defense data systems and suggested the U.S. government’s appetite for Palantir’s technology remains strong. The announcement helped vault the stock back up toward $120, rounding out the series of catalysts that hit in quick succession.

What’s Not Working?

TAM for government remains difficult to predict: While Palantir’s government segment remains a strong revenue driver, its future scalability is fraught with uncertainty. Unlike commercial sectors where TAM can be modeled with more granularity, government spending is highly cyclical and often tied to opaque procurement processes, changing administrations, and shifting geopolitical priorities. Furthermore, a large portion of Palantir’s government contracts are short-term in nature or subject to termination clauses, making it harder to forecast future cash flows with confidence. Compounding this uncertainty is the underperformance of Palantir’s international operations. The international commercial segment, which shares similar challenges with the international government business, reported a 5% YoY and 11% QoQ revenue decline. Europe, in particular, has lagged due to regulatory hurdles and growing skepticism around AI deployment. As such, the lack of a clear runway or structural growth baseline in the government vertical leaves investors without a dependable framework to price long-term upside.

Equity dilution continues to distort valuation: Palantir’s aggressive use of stock-based compensation (SBC) remains a persistent concern. In Q1 2025, the company’s diluted share count rose from 2.4 billion to 2.55 billion—a jump of 155 million shares in a single year. This dilution effectively added nearly $19 billion in market cap without a proportional rise in earnings, undermining value for existing shareholders. At the current pace, continued issuance could inflate the share count to 2.8 billion or more by 2027, significantly dampening any future upside from EPS growth or price expansion.

Rule of 40 may not fully reflect financial health: While Palantir boasts a strong Rule of 40 score of 83 (revenue growth + adjusted operating margin), this figure is based on non-GAAP metrics and heavily excludes recurring SBC costs. When recalculated under GAAP, the Rule of 40 drops to just 59. This discrepancy suggests that Palantir’s profitability optics are enhanced by adjustments that don’t reflect the real cost of talent retention. Investors should be cautious interpreting this metric as an indicator of sustainable efficiency.

Analyst Sentiment Shift: Following the earnings pop, some on Wall Street urged caution on valuation. Jefferies, for example, downgraded Palantir to “Underperform” the very next day, arguing that at ~$120+ the stock was priced beyond perfection. They highlighted Palantir’s 238× P/E multiple – astronomical even against other AI winners like NVIDIA (~26×) or Broadcom (~31×) – and noted that much of the good news (e.g. U.S. commercial growth “unparalleled” per CEO Karp) was likely already baked into the stock. This catalyzed a brief pullback to ~$115 as investors digested the idea that future growth might not accelerate indefinitely.

4. Valuation and Investment Opinion

DCF projection: As shown in the table below, we forecast EBITDA growing from $3.9B in 2025 to ~$4.2B by 2029. We discount each year’s cash flow to present value (using 10% discount rate), and also calculate a terminal value in 2029 by capitalizing 2029’s FCFE at a 5% growth perpetuity. Summing the present values of all cash flows, we derive an equity intrinsic value of approximately $58.4 billion. With ~2.0 billion shares outstanding, this equates to a per-share value around $25. Meanwhile, we also use EBITDA approach for DCF to valuate PLTR. The terminal value in 2029 is based on a 541.5x multiple of EBITDA (~$416 million), resulting in a terminal value of ~$225.29 billion. Discounting this yields a present value of ~$139.89 billion. Including the same discounted UFCFs, the total enterprise value becomes ~$155.30 billion. After adjusting for net debt and share count, the equity value per share is $62.49.

Both results starkly illustrate the valuation gap between fundamentals and the current $120 share price. Even after significantly boosting our near-term forecasts (compared to the prior model) to reflect Palantir’s “crushing consensus” growth, the DCF-inferred value is only half of the current stock price at most. In other words, the market is pricing in extremely optimistic assumptions far beyond our base case. To sanity-check this, we ran scenario analyses: for instance, even if we assume a more bullish scenario with a 8% discount rate and 5% terminal growth (implying lower risk and perpetual high growth), our model’s fair value would rise to only ~$20–$25 per share. Such sensitivity tests underscore that only extraordinary growth outcomes (e.g., sustaining 40%+ growth for a decade, or massive unmodeled new revenue streams) would begin to justify a $120 valuation in a DCF framework.

We also updated our peer multiples comparison to ensure our view aligns with relative valuation signals: At $120, Palantir trades at over 60× forward 2025 sales and roughly 240× forward earnings (based on ~$0.50 EPS). This valuation is an outlier even among high-growth tech. For example, Snowflake at ~$50B market cap is ~14× forward sales (with ~27% growth) and isn’t profitable; and enterprise software peers like Oracle or Microsoft (while not pure plays) trade around 20–30× earnings. Palantir’s EV/EBITDA is also extremely high (well above 100× using 2025 EBITDA). The market is clearly assigning a scarcity premium for Palantir’s growth + profitability combo and its positioning in AI.

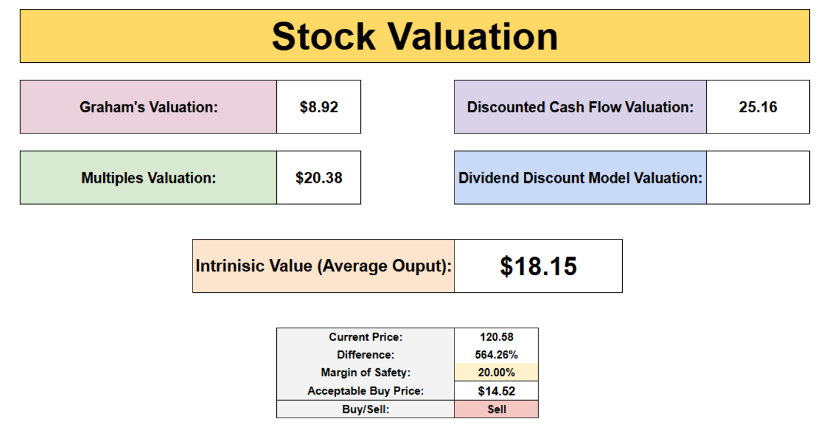

Considering other two valuation methods to validation, the Graham’s Valuation give a $8.92 for PLTR, and Multiples Valuation regards $20.38 a rational price. The current market price of the stock is $120.58, which is significantly higher than the estimated value. This reflects an average 664.26% overvaluation.

Valuation remains stretched despite execution: PLTR currently trades at over 100x price-to-sales, an extraordinary multiple even by high-growth tech standards. While execution has been solid, such a valuation bakes in near-perfect growth execution for years to come. At these levels, any slowdown in demand, regulatory shifts (especially in Europe), or intensifying competition—such as from Microsoft’s Factory Operations Agent in the manufacturing space—could trigger a meaningful re-rating. Historical parallels, like the decline in Snowflake’s stock after peaking in 2021 despite continued growth, illustrate the risks of overpaying in an overheated AI narrative.

Investment Opinion

Valuation Summary: Given the unique attributes of technology companies, relying solely on valuation models such as DCF is not justified. After balancing the potential revenue upside from the broad growth prospects of AI against uncertainties stemming from the high exposure to government markets (and its impact on Total Addressable Market, TAM), we have decided to maintain our prior valuation of $90 per share without adjustments at this stage.

Recommendation: We are changing our rating on Palantir to “Sell” (Trim Holdings) from a prior neutral stance. The stock’s rapid ascent to $120 has, in our view, priced in excessive optimism about Palantir’s future. While we remain believers in Palantir’s long-term prospects and unique competitive position, the current valuation leaves little margin of safety. We advise investors to take profits at these levels.